How Georgia Supplies Sanctioned Vehicles

Author: Ia Asatiani

Georgia continues to be a corridor for sanctioned automobiles to enter the Russian market. Our seven-month investigation has found that despite the Georgian government’s assertion that it honors the ban on the export of sanctioned vehicles to Russia, these operations persist. This risks setbacks for Georgia on its path to the European Union.

On July 19, 2023, I visited the Georgian-Russian border at Lars to observe customs operations, how individuals from Russia crossed the border, and how thoroughly the cargos en route to Russia were inspected.

On several occasions, I observed tow trucks delivering new luxury cars. These included black Toyota Prados valued at around $80,000. The tow trucks would drive these vehicles behind an old three-story building and return empty.

I explored behind the building and discovered an “auto heaven” spanning 1,400 square meters. There were more than 30 new cars worth approximately $2 million. The car park is situated just 200 meters from the border checkpoint, behind the hotel where border police stay, and is monitored by surveillance cameras.

When a security guard noticed my presence, I said I had never seen so many new cars. He asked me to leave the territory.

After leaving, I spoke with a tow truck driver who revealed that he transports these new cars from Tbilisi to the border two or three times a week, destined for sale in Russia.

Due to Russia’s war in Ukraine, the European Union has sanctioned the export to Russia of cars selling for more than 50,000 euros. Our seven-month investigation revealed alternative schemes that bypass sanctions.

The Georgian government officially banned car exports to Russia in August 2023, aligning with international sanctions. But hundreds of sanctioned vehicles continue to enter Russia daily through Georgia. As one of the drivers prepared to export cars to Russia told me: “This is all a farce.”

Easy Trip Across the Border

Following the discovery of the luxury car park, I spent five hours at the border.

I observed a straw-colored Porsche Cayenne, valued at approximately $70,000, exit the parking lot from its secluded location. The Porsche queued at the border crossing, patiently awaiting its turn for about an hour.

Upon reaching the crossing booth, the driver had his documents checked for about five minutes and then proceeded without any issues. Accompanying it, a “BMW X5” also crossed the border, a vehicle I had seen in the luxury car parking lot.

Parking in that lot is limited, and every departing car is quickly replaced by a new one. Car carriers deliver new cars from various auto centers in Tbilisi and the huge Rustavi auto market.

The value of these parked cars ranges from $30,000 to $130,000. Almost all are new, unregistered, and still in their original protective packaging. The absence of a license plate indicates these cars had not been driven at all within Georgia; they are transported directly from auto centers or markets to the border by car carriers.

- Upon reaching the border, the driver unloads the car from the carrier and moves it into the parking lot.

- The next step involves obtaining a temporary number required for crossing the border.

- Then the driver takes the car to the border.

On the Russian side, these cars are met by a driver or another car carrier and continue the journey to Russia.

This scheme ensures cars reach their new owners in undamaged condition with minimal mileage. The Georgian driver returns, either crossing the border on foot or in another vehicle.

Crucial to the scheme is that sanctioned cars can pass into Russia without being officially recorded in export statistics. Georgian legislation considers it the driver’s business if a car is taken across the border; it is simply viewed as personal travel by car.

As clarified by the National Statistics Bureau of Georgia, they include in the export database only those cars for which a customs declaration is filled out in Georgia. Cases of individual use, such as when a driver takes a car across the border and clears customs in another country, are not recorded in Georgia’s export/re-export database.

This information was also confirmed by the Revenue Service of Georgia, who stated in correspondence on January 31, 2024:

“Sanctions do not apply to vehicles registered in another country, owned by an individual, driven into the Russian Federation, and not intended for sale.”

I witnessed firsthand how dozens of new cars cross the Georgia-Russian border. The parking lot was consistently full during my visits to Lars in July, September, and November. During seven hours on July 19, 15 new “Toyota Prados” worth between $60,000 and $100,000 were prepared to cross into Russia.

On my way back to Tbilisi from Lars in September, I counted 97 such cars for transit in just over three hours. Some were transported by car carriers, and some were being driven.

The following steps are necessary to cross the border with a sanctioned vehicle with a transit number:

- The buyer in Russia must place considerable trust in the transporter to transfer ownership by signing the car registration in their name.

- The transporter must purchase car insurance and sign a car purchase contract.

- Following the car’s trip across the border, the transporter enters a new contract with the receiving party, completes the sale, and returns to Georgia.

Border guards witness the same individuals drive luxury cars across the border and return on foot multiple times. During our third visit to the Lars checkpoint in November, the police presence at the border prevented asking border guards questions or even approaching the border itself.

One driver, who had transported two cars to the border and was awaiting the arrival of a new owner from Russia, said the ban does not effectively hinder transactions:

“They transport new cars with a tow truck because the new owner prefers the vehicle not to have any mileage. The car enters Russia seamlessly. This ban is essentially fictitious. I brought the second car with a tow truck, I’ll unload it, and the owner will take it.”

How Russians Profit

The official list of car exporters from Georgia predominantly features foreign names and surnames. A quick online search turned up 15 dealers using video blogs to sell cars from Georgia to Russia.

Among the most prominent bloggers is Anton Buy, boasting 111,000 followers on Instagram. He’s 36-year-old Russian citizen Anton Baibursyan. Like countless others, migrated to Georgia following the start of the war in Ukraine. Anton almost always wears the same t-shirt in his videos, advertising his YouTube channel. On his sleeves are flags of Georgia, Armenia, Kyrgyzstan, and Kazakhstan — countries where Anton does business supplying cars to Russia.

In his videos, Baibursyan often brags about purchasing cars from Georgian dealers for as much as $10,000 below market value due to a current surplus of vehicles in Georgia.

He frequently mentions the “Toyota Center” in Tbilisi. In a video published on June 16, 2023, he asserts that “the entire Toyota Center operates through him,” and encourages anyone who wants a new Toyota without additional fees to contact him directly.

“Toyota Center Tbilisi” owner Irakli Gurchiani says the center has no affiliation with Baibursyan and does not provide discounted prices or other advantages as suggested in the blogger’s videos. Gurchiani characterized the statements made in the videos as advertising tactics employed by Baibursyan.

“We have not sold a single car to this individual,” Gurchiani stated. “If he engages in transactions involving our vehicles through third parties, we lack the means to control such arrangements.”

Baibursyan also imports second-hand vehicles from the USA and Canada for export to Russia.

In the past year, he has exported 1,960 cars to Russia. Charging a minimum fee of $1,000 per car, Anton’s earnings in Georgia for the past year amounted to at least $1,960,000.

Baibursyan filmed videos at the huge Rustavi car market in the early stages of his Georgian operations. As evidenced by his social media, he gradually expanded his business, hiring staff and securing office space within the Rustavi auto market. He is currently assisted by a team of at least nine individuals, as shown in his videos, who also wear T-shirts with flags and speak Russian. He is now entering the Chinese market, and establishing a branch in his hometown of Samara, Russia.

In the autumn of 2023, we used a Russian phone number to text Baibursyan and tell him we were interested in buying a car from Georgia. He said he offers a comprehensive service package for customers, including assistance with transportation to Georgia and hotel accommodation. He also offered a meeting upon arrival in Yerevan, Armenia, and aid in currency exchange. He said one can transport any amount of cash from Russia to Yerevan without declaring it. He suggested it is cheaper and more convenient to fly to Yerevan and then cross the Armenia-Georgia border without any issues.

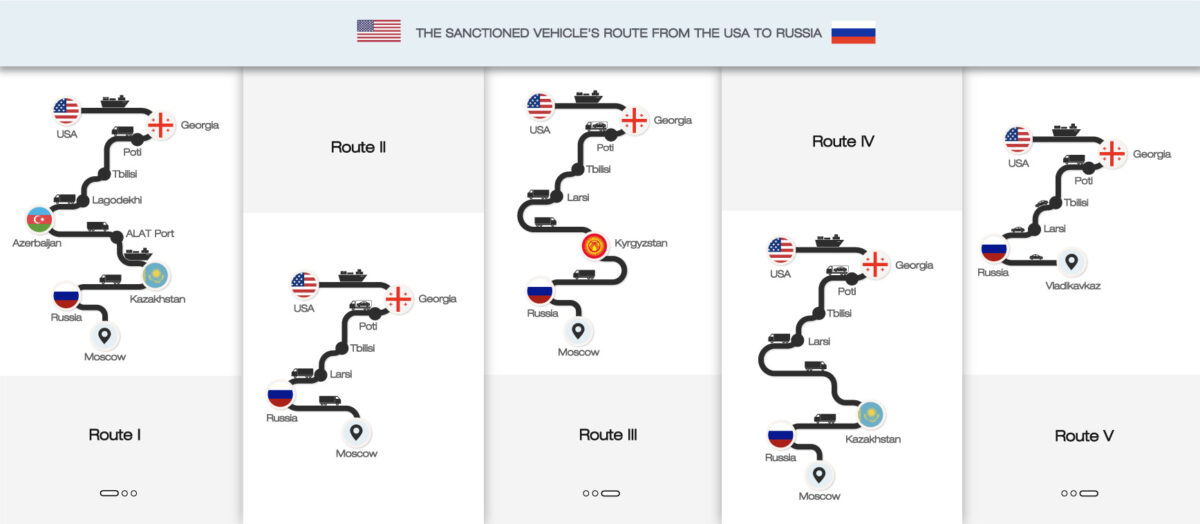

He explained there are four methods for exporting cars to Russia: directly from Georgia, or through Georgia from Armenia, Kazakhstan, or Kyrgyzstan.

He said approximately 80 percent of customers opt for remote purchasing, trusting him with the selection process without physically visiting Georgia. Ultimately, these vehicles are either delivered to Vladikavkaz or directly to the customer’s residence.

Before a customer selects a car remotely, a payment of $500 is required. Baibursyan then adds the customer to a closed online group with other remote buyers. Within this group, the customer is presented with a selection of 10 cars at an agreed-upon price. If an option is chosen, another $500 is paid, initiating the registration procedures.

But if none of the options are selected, a service fee increases. The client is expected to pay 15-20 percent of the car’s value before finalizing the selection, a process that typically takes eight days on average. Then the purchased car is delivered to the customer, and it gets Russian license plates.

Baibursyan accepts payments in Russian rubles and US dollars. Customers have the option to provide the remaining balance in cash to a member of his team responsible for transporting the car across the border.

Baibursyan typically opts for individual crossing, where the car is driven across the border rather than using a car carrier. He frequently shows his team members delivering cars to Vladikavkaz in his videos, capturing moments where they hand over keys to new owners. In one video shot near the Russian-Georgian border, he showcases new cars lined up in a parking lot, ready for export to Russia.

We went to his office in November 2023 but couldn’t find him. We reached him and he agreed to a phone interview but didn’t answer at agreed-upon times.

We sent the questions to his Russian number on WhatsApp. We were interested in:

- When and how did he start the business? Who are his competitors?

- What obstacles did he overcome when setting up the business and who helped him to familiarize himself with Georgian legislation?

- What types of cars are in greatest demand in Russia and who buys them?

- How does he cooperate with the Toyota Center and how long does he have to wait to buy a car?

- What taxes does he pay in Georgia?

- Did he have any problems with the Georgian Revenue Service?

- In his opinion, what problems can Georgia face when he and his team bypass sanctions and export banned vehicles to Russia?

We did not receive a response to these questions.

Georgian dealers struggling

Baibursyan’s team is thriving, and similar auto bloggers have gradually replaced Georgian auto dealers.

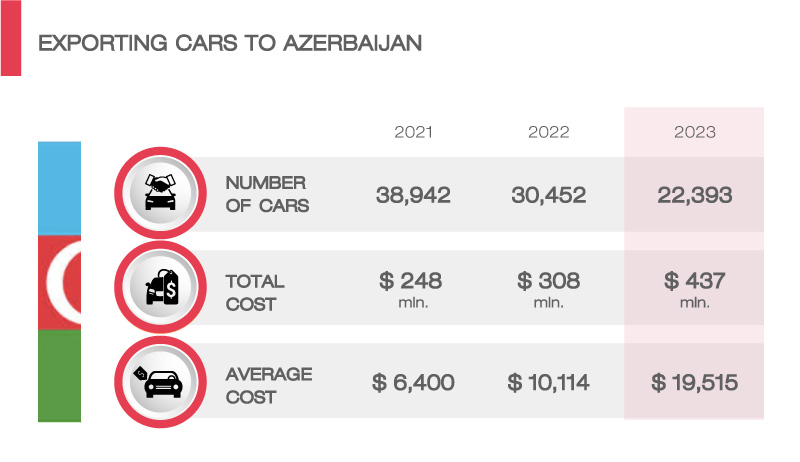

Historically, Georgia has been a primary source of used cars for neighboring countries. This dynamic has shifted, and the COVID-19 pandemic exacerbated this situation with the closure of the Azerbaijani market due to border restrictions.

The Georgian car business lost its Ukrainian market at the start of the war. Russia emerged as a new partner. Russian buyers predominantly sought 3- to 5-year-old cars, prompting Georgian dealers to adjust their offerings accordingly by importing newer, relatively expensive vehicles for resale. The costs associated with transportation and service fees from the USA surged, leading to an overall increase in car prices.

But this Russian market boom proved to be short-lived, about 18 months. Demand from Russian buyers gradually diminished as immigrants from Russia residing in Georgia began importing and selling cars. Georgian dealers report there is now a scarcity of Georgian buyers because they can’t afford the increasingly expensive cars available.

Avtandil Zarnadze has been a dealer in the Rustavi auto market since it opened in 2009. He says he has seen many crises, but nothing like this one. He has been waiting for eight months in vain for his cars to sell.

“Regarding Russian tourists, we said that let them come, eat in Adjara, and rent an apartment. However, if you visit Adjara now, you’ll notice a significant shift,” he said. “When a Russian needs a taxi, they’ll call their service, staffed by fellow Russians. Georgian businesses have been edged out. Russians have rented cafes and bars. A Russian does not go to a Georgian’s bar, he goes to a Russian’s bar. They bought apartments and Russians are renting them now. The same has happened here (at the auto market).”

A Saturday in November used to be a bustling day for sales at the Rustavi car market. But in 2023, there were fewer shoppers. Russian, Kazakh, and Kyrgyz car dealers and their clientele dominated the scene.

Another Georgian car dealer revealed they are selling cars below cost due to the downturn in the business. Zaza Sukhitashvili said he had been attempting to sell a Kia Optima in Rustavi for over three months.

We spoke with 12 Georgian car sellers at the Rustavi market. They said that if cars remain unsold for 90 days, they are transferred to a terminal, where a daily fee of 10 lari (about $3.80) is applied. Eight respondents showed us SMS accumulating fines, with some owing over 2,700 lari (about $1,025). The cars cannot be removed from the terminal without settling this debt.

All the Georgian car dealers we spoke with voiced frustration over the market’s unprecedented crisis. They noted the scarcity of buyers and a doubling in the number of car dealers. They emphasized the necessity of selling cars at significantly reduced prices to pay their bank debts. Foreign dealers capitalize by acquiring cars from Georgians at lower prices.

Baibursyan, the Russian online car dealer, frequently boasts about purchasing cars for low prices from Georgians. “Are you seeing this $45,000, guys? (as displayed on a special letterhead),” he remarks in a video published in July, showcasing the price for a 2019 Chevrolet Corvette. “No, friends, they’re already selling it for $37,000.”

At the Rustavi market, numerous offices have advertising offering services for customers looking to transport cars to Russia. We noticed over 20 vehicles with transit numbers (which are assigned to cars for border crossings) parked in the yard of the “Autopapa” hotel, located at the market entrance. Foreigners told us that these cars were being prepared for journeys to Russia, with their drivers taking a break at the hotel.

We also visited the Black Sea port of Poti. On December 22, most of those waiting in the terminal were Russian speakers. We encountered a truck driver who transited cars to Armenia. We inquired about the final destination of the vehicles.

“I am taking the car to Armenia. The paperwork will be sorted there, and then it will be exported to Russia. Everybody operates like this these days,” explained the truck driver. He said these used cars would undergo repairs in Armenia before being shipped to Russia.

We witnessed the departure of 10 cars from the Poti terminal. Three were met by an individual in a car with Russian license plates. Two other cars had Armenian license plates.

Four Schemes for Transporting Cars from Georgia to Russia

After the start of the war in Ukraine in 2022, numerous countries worldwide imposed sanctions on Russia. Dozens of car manufacturers withdrew from the Russian market, leaving a void that Chinese companies swiftly filled. However there was still a scarcity, prompting Russian citizens to explore alternatives through neighboring countries, including Georgia.

“Export” is defined as the transportation of cars by car carriers that are declared in Georgia. Instances of individual use, where a driver takes a car across a border and clears customs in another country, are not documented in the export/re-export database.

The re-export/export into Russia of electric and hybrid cars manufactured in the USA or the European Union, with an engine capacity exceeding 1,900 cm3 and a value surpassing 50,000 euros, is subject to sanctions.

Despite sanctions, most cars going from Georgia to Russia are from the USA. Official government data from Geostat lists the USA as the top car importer of Georgia, followed by Japan and Germany.

According to 2023 Geostat data, there was a remarkable surge. Imports from all countries increased by 131 percent over 2022, while exports grew by 135 percent. In 2023, 94 percent of cars exported from Georgia went to Kazakhstan, Azerbaijan, Armenia, Kyrgyzstan, and Russia.

The Russian video car dealer Baibursyan told us he uses various routes to transport cars into Russia. These routes commonly include passage through Armenia, Kazakhstan or Kyrgyzstan. These three countries, along with Russia and Belarus, are members of the Eurasian Economic Union (EEU). This membership facilitates processes for car dealers, as members benefit from a unified system of customs clearance. Cars cleared or purchased within these countries do not require additional customs clearance when entering Russia.

Even before Russia’s war with Ukraine, Armenia relied on car imports from Georgia. In 2020 and 2021, Georgia exported 1,622 cars to Armenia, with average values ranging from $5,000 to $8,000. In 2022 and 2023, exports surged significantly to 29,269, with the average value per car ranging from $12,000 to $17,000.

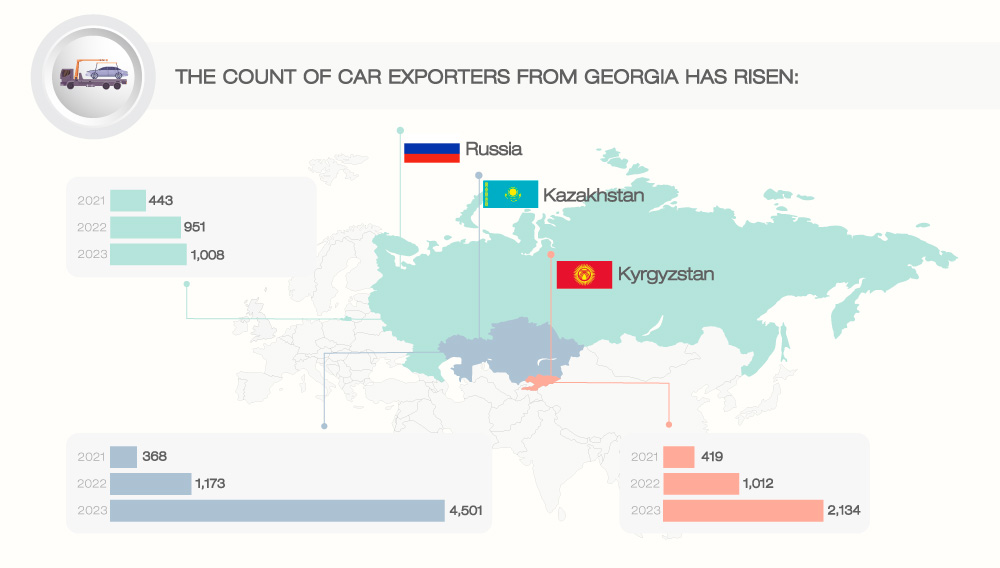

Before the war, a small number of cars went from Georgia to Kyrgyzstan and Kazakhstan. Since the war, exports to Kyrgyzstan increased by 680% in 2023 compared to 2021, and to Kazakhstan by 1,750%.

Exports from Kyrgyzstan to Russia have also experienced significant growth. In 2021, 308 cars were sold from Kyrgyzstan to Russia. In the first 11 months of 2023, this number surged to 5,761.

The notion that cars dispatched from Georgia to Kazakhstan and Kyrgyzstan are ultimately destined for Russia is confirmed by the fact that companies and individuals who exported cars to Russia before the war now transport cars to Armenia, Kazakhstan, and Kyrgyzstan instead, according to official data provided by Geostat.

When a buyer purchases a car in Georgia from a Georgian citizen to resell or export, they complete an export declaration. Export statistics encompass all entrepreneurs who sell cars within Georgia, even if the buyers are foreign citizens acquiring the cars not for personal use but for resale purposes.

Tbilisi resident Elnura Jafarova, 33, exported cars only to Russia in 2021. In 2023, she exported to Azerbaijan, Kyrgyzstan, Kazakhstan and Russia. Jafarova sells cars valued at over $100,000 in all these countries except Kyrgyzstan. She abruptly ended a phone call upon learning she was talking to a journalist. Subsequent attempts to reach her have been unsuccessful.

Asim Ansarov, a 30-year-old resident of Marneuli near Tbilisi, has been buying and selling cars for over a decade. Ansarov also initially sold cars to Russian citizens, but since the war, he has shifted his focus to selling cars to citizens of Armenia, Azerbaijan, Kyrgyzstan and Kazakhstan.

During a phone conversation, he explained that he operates in the Rustavi market and is unaware of the ultimate destination of the cars once sold.

“Car customs clearance in Russia is prohibitively expensive,” Ansarov said. “That’s why cars are imported from Kyrgyzstan and Kazakhstan. They are brought into these countries from Georgia, undergo customs clearance there, and are subsequently transported to Russia.”

Amidst escalating exports to Russia, the Georgian government felt compelled in the summer of 2023 to impose limitations on car exports to partially align with the 11th package of international sanctions. Directly transporting cars manufactured in the USA and the EU to Russia via truck carriers was banned. Notably, the Georgian government has remained silent on this development. We learned about it from a video by Baibursyan.

Following this restriction on truck carriers, two alternative avenues emerged for supplying the Russian market with cars: individual car exports and exports facilitated through intermediary countries.

Export through Azerbaijan

In addition to the restrictions, winter complicates travel towards the Russian border crossing at Lars. So, dealers began using an elongated route to Russia through Azerbaijan.

A car carrier with vehicles from Georgia travels to the border at Lagodekhi, crosses into Azerbaijan, and proceeds to Port Alat on the Caspian Sea in Baku, where the cars are loaded onto a ship bound for Kazakhstan. The cars are then transported from Kazakhstan into Russia.

“Yes, I take these cars to the port in Azerbaijan first, then they proceed to Kazakhstan from the port. From there, the route changes, and half of them head to Russia. I take at least seven cars per week with this route through the Lagodekhi border. I have my own car carrier in Kazakhstan, and I transport a portion of the cars to Russia,” said Gunduz, the Kazakh driver of a car carrier whom we encountered in Rustavi while he was preparing cars for shipment.

Four additional sources said they also transported cars from Georgia to Kazakhstan through the port in Azerbaijan.

We studied pictures of that port, where dozens of new cars were waiting to be exported. According to an official statement from the port administration, 45,368 cars were exported through the port between January and October 2023. The statement did not specify the destination countries for these exports.

While we were at the Rustavi market, dealers told us there was a queue of cars at the border in Lagodekhi. We went there on December 26.

There are four parking lots near the border for trucks and trailers waiting to cross. In three of them, we found truck carriers loaded with cars. Locals and truck drivers don’t hide the fact that most of these cars undergo document alterations in Kazakhstan before proceeding to Russia.

“They bring a substantial number of cars. We witness at least 10-15 truck carriers passing by daily, each loaded with 5 to 8 cars,” locals residing along the road leading to the border said.

Could Georgia Be Sanctioned?

Russia routinely circumvents sanctions by procuring restricted goods through intermediary countries. Kyrgyzstan frequently assists in these efforts. In the summer of 2023, the U.S. government announced plans to add Kyrgyzstan to the list of sanctioned nations.

The question arises whether Georgia could also find itself on the list of sanctioned countries. We posed these questions to American and European groups working on sanctions.

A spokesperson from the U.S. Treasury stated that U.S. government agencies, including the Departments of State, Commerce, and the Treasury, have closely collaborated with Georgian partners over the past year to counter evasion and prevent the flow of these goods into Russia. The official response from the Treasury emphasized, “We will continue to work with Georgian authorities to address this crucial challenge.”

During a visit to Tbilisi in June of 2023, David O’Sullivan, the International Special Envoy for the Implementation of EU Sanctions, addressed auto exports. “If Georgian citizens import cars from the European Union with the intention of re-exporting them to Russia, it will be perceived as a blatant attempt to circumvent sanctions,” he emphasized.

We asked Georgian specialists about potential threats. to Georgia stemming from these schemes. Economist Davit Shatakishvili, currently pursuing his Master’s program in Development Economics in the US, has conducted extensive research on sanctions in Georgia and published articles on the Georgian Strategy and International Relations Research Foundation website.

“Georgia officially re-exports cars to Central Asian countries; from there, we cannot control where the cars are transported,” he said. I don’t believe this process should be interpreted as Georgia’s involvement in the sanction’s avoidance scheme. The European Union has acknowledged numerous shortcomings in the enforcement of sanctions. Several experts, including those from the American side, have stated that Georgia is complying with the sanctions imposed against Russia.

“However, if any wrongdoing is revealed and confirmed, it will undoubtedly cause significant reputational damage. It’s challenging for me to predict the economic consequences, as we don’t know what the punishment could entail.”

We sent letters to the Administration of the Government of Georgia, the Ministry of Internal Affairs, and the Revenue Service, responsible for monitoring imports and exports.

We sent the following questions to the Administration of the Government of Georgia:

- Given the Government’s decision to prohibit the export of sanctioned cars (valued at over 50,000 euros or with an engine volume exceeding 1.9 liters) to Russia since the fall of 2023, we note that despite the ban on exports via car carriers, sanctioned vehicles from Georgia continue to reach Russia through Armenia, Azerbaijan, Kazakhstan, and Kyrgyzstan. Does the Government view Georgia’s involvement in this scheme as potentially damaging to the country’s reputation or as a threat in terms of potential economic sanctions from Western partners?

- Is there any awareness within the Government regarding these schemes, and is there an ongoing discussion regarding potential solutions to address the issue?

- How does the Government plan to limit the export of sanctioned cars to Russia, particularly concerning the practice of individual transportation to the border, where the new owner meets the vehicle on the Russian side, and the driver returns to Georgia?

- Various car dealers of different nationalities, including Russians, operate in Georgia, selling sanctioned cars to Russia from Georgian territory. These dealers establish offices, expand their operations, and generate significant profits. What steps are the government taking to investigate and halt the activities of these individuals?

We sent the following questions to the Border Department of the Ministry of Internal Affairs:

- Is the data regarding vehicle models and marks collected at the border? If such statistics are available, please share the Lars border data for 2022 and 2023.

- Is there a requirement for car drivers to specify the vehicle’s final destination when crossing the border?

- Are the records of individuals who depart from the Lars border by car (with transit numbers) and return within a few hours maintained? If so, how many such occurrences were documented in 2022 and 2023?

- Does the repetitive crossing of the Lars border point by a specific individual, as described above, draw the attention of border police? Additionally, how frequently must such crossings occur per week/month for the border police to take an interest in the matter?

- We have observed instances where individuals cross the border with high-value cars (prohibited to export in Russia) and return on foot, occurring several times daily at Lars. We monitored the border in July, September, and October and noted numerous occurrences. We believe that you may also possess information on these occurrences. What actions have been undertaken in response to this?

We sent the following questions to the Revenue Service:

- Why is it not considered an export when the driver transports a sanctioned car with transit numbers to the border, it is received by a new owner on the Russian side, and the Georgian driver returns on foot? Numerous vehicles pass using this scheme daily at Lars, yet the export statistics do not reflect this activity.

- It appears that Georgia is inadvertently aiding Russia in avoiding sanctions through this method. Russian car dealers operating in Georgia are utilizing the scheme described above to transport dozens of sanctioned cars to Russia. What steps can the Revenue Service take to address this apparent loophole?

- What taxes apply to individuals engaging in such business activities, and how does this contribute to Georgia’s budget? Has the country quantified the benefits or losses incurred from facilitating Russia’s sanctions evasion through this business?

- Another method for exporting sanctioned cars from Georgia to Russia involves routing them through intermediary countries such as Armenia, Kazakhstan, Kyrgyzstan, or Azerbaijan before reaching Russia. What strategies can the Revenue Service implement to prevent Georgia’s involvement in this scheme?

We sent the letters on January 24, 2024, and received confirmation from all three agencies that the correspondence was successfully delivered. We requested responses by February 1. On January 30, the government administration forwarded our letter to various agencies.

So far, only the Revenue Service has replied, and did not address any of our specific inquiries. Instead, they stated: “Since introducing the international sanctions against Russia, a working group within the Customs Department has been created to control enforcing sanctions and implement preventive measures throughout Georgia.”

“According to existing regulations, the re-export or transit of sanctioned vehicles to the Russian Federation is not documented.”

Our investigation and the evidence we gathered contradict these statements.

What is the Solution?

We found one answer relatively easily in the case of individual crossings, using the example of the Sarpi customs checkpoint between Georgia and Türkiye.

The Sarpi customs checkpoint enforces a regulation imposed by Türkiye according to which individuals can only transport cars to Türkiye if they have owned them for at least six months. Implementing a similar rule at the Lars customs checkpoint could significantly tighten the loophole car dealers use to supply sanctioned vehicles to Russia.

We can learn from the experience of Lithuania, where measures were taken to address a similar issue. In July 2023, Lithuanian investigative media outlet LRT.LT uncovered a scheme for transferring luxury cars from Lithuania to Russia via Belarus.

We reached out to the author of the article, Mindaugas Aushra, to inquire about the actions taken by the Lithuanian government following the publication of their findings.

They replied to us in 40 minutes and shared that Lithuanian Customs launched an investigation into the matter after the article was published. They identified a list of companies transporting luxury cars to Russia through intermediary countries. The investigation revealed that during the summer of 2023 alone, cars worth 43 million Euros were transported through Lithuania to Russia. Additionally, Lithuanian Railways conducted their investigation and identified 447 vehicles suspected of being transported to Russia via the railway network.

Lithuanian customs officials implemented several bans in November 2023:

- “LT CARGO,” a subsidiary of Lithuanian Railways, ceased transporting luxury cars manufactured within the last five years or valued at 50,000 euros and above to third countries.

- A new requirement mandated that manufacturers must have information on the final buyer of the car, and exporters must provide this information to Lithuanian Customs.

- An additional document is required to export expensive cars, obliging the final buyer not to sell the vehicle without adhering to international sanctions.

- Exporters whose vehicles passed through third countries before reaching Russia were banned from exporting goods to third countries until investigations were completed.

It remains uncertain whether the Georgian government will implement similar measures against car dealers who facilitate the supply of sanctioned cars through Georgia to Russia. By taking such action, the government could address the loopholes that have turned Georgia into an “Auto Heaven” for Russians.

Contributors to the article: Aidan Yusif (Reporter); Natia Mikhelidze (Reporter); Nino Bakradze (Editor); Robi Zaridze (Videographer) and Nino Gagua (Designer)