Despite sweeping Western sanctions on Russia following its 2022 invasion of Ukraine, European-made trucks—including models from Volvo, MAN, Mercedes, and Scania—continue to appear on Russian roads. A detailed investigation by iFact reveals how these vehicles, officially banned from the Russian market, are still finding their way into the country through complex re-export schemes involving Georgia and its regional neighbours.

In this article, you will find numerous facts, data, and evidence on how Russian companies utilize Georgia to receive sanctioned cargo, specifically trucks in this case. If you follow us and read our articles, the fact that Georgia participates in schemes to evade sanctions will no longer be unfamiliar or surprising. Here are the investigations we published in the last two years:

- Russia’s “Auto Heaven” – The Route of Sanctioned Vehicles from Georgia to Russia

- Sanction Evasion: How Georgia Facilitates Russia’s Military Supply Chain

- Ghost Cargo: The Hidden Journey of Sanctioned Oil to Europe

- The Sanction Loophole: Heavy Machinery’s Hidden Route to Russia

Research Methodology

The data discussed in the article was collected from international trade databases, including Volza, Importgenius, Exportgenius, Comtrade, Sayari, and Trademo. We also requested data from the statistics offices of Georgia, Armenia, Uzbekistan, Kazakhstan, Tajikistan, and Kyrgyzstan. The collected information was analyzed and compared to identify any differences and inaccuracies.

According to Georgia’s statistical data, the export-import of trucks in the country mainly occurs under the international trade code 8704. However, in international data databases, we found cases where trucks from Georgia were exported under code 8701, which in other instances corresponds to heavy machinery. We also observed that in recipient countries, such as Russia, Kazakhstan, Kyrgyzstan, and Turkey, trucks exported from Georgia under code 8704 were, in some cases, received under code 8701.

You will see in the article that sanction evasion schemes are explained using examples of different companies. We obtained data about them from international databases.

In the case of these companies, we confirmed this through facts and evidence that the trucks they frequently sent to third countries ultimately ended up in Russia. This was done as follows: we compared the VIN codes (unique vehicle numbers) of the equipment imported to Georgia and then sold to third countries to the trucks finally imported into Russia. We also compared data from different databases and filled in the missing information, as well as the route that the sanctioned cargo had taken.

Databases Used:

“ImportGenius” – A foreign trade portal created in the state of Arizona, USA, which collects data from countries in Europe, Asia, North and Latin America. It relies solely on official documents sent by customs authorities.

“Volza” – An international database established in the state of Delaware, USA. It also gathers trade data from official structures and customs declarations.

“Comtradeplus” – A foreign trade portal of the United Nations that compiles statistics from official customs data of various countries around the world.

“ExportGenius” – A foreign trade platform based in India, which collects detailed export and import data from over 60 countries. It relies on customs declarations and official trade records.

“Sayari” – An international research and sanctions risk platform that assesses companies’ links to sanctioned entities by analyzing information collected from various databases. It uses open sources, legal, and financial data to determine the company’s risk level, including the status of “sanctioned-adjacent”.

“Trademo” – An American technology company that integrates global trade data. It enables the tracking of supply chains, identification of trade partners, and detection of suspicious movements.

Schemes and Findings

The sanctioned trucks typically enter Georgia from Europe, are registered for re-export to Central Asian or other third countries, and then quietly divert to Russia—either by passing through its territory en route or being rerouted mid-journey. VIN code tracking and international trade data reveal discrepancies between the declared destination and the actual endpoint.

In six international databases, we studied who was supplying trucks to Russia and from where. We examined more than 300 VIN codes (unique vehicle identification numbers) and confirmed that 110 of them were transported from Georgia to Russia in violation of international sanctions. Ultimately, we uncovered a mix of previously known and newly emerging schemes.

Scheme 1: Trucks are sold from Georgia to Turkey and other third countries, and from there, they go to Russia.

Scheme 2: Trucks are exported from Georgia to Kyrgyzstan, Kazakhstan, and Uzbekistan, but they do not reach their final destination and stay in Russia. The transport heading to these countries must pass through Russia on the way.

As a result of these schemes, Georgia’s customs data does not match the data from international databases and customs records of the so-called “third countries.” Hundreds of trailers are exported from Georgia, but are not received in the countries to which they were declared to be destined.

The import of such equipment into Russia was banned by the European Union and other Western countries starting in 2022, after sanctions were imposed on Russia for invading Ukraine. The aim was to weaken Russia’s military supply and economy. Following this decision, European and American vehicle manufacturers also exited the Russian market. However, with the help of such schemes, European-manufactured trucks (such as MAN, Mercedes, Volvo, and Scania) are still freely sold on the Russian market.

If you browse Avito.ru, one of Russia’s most well-known vehicle trading websites, you can easily find more than 1,000 listings for truck sales. Many are German Mercedes and MAN, Swedish Volvo and Scania. Some of these were manufactured as recently as 2023–2025.

What Do the Data Tell Us?

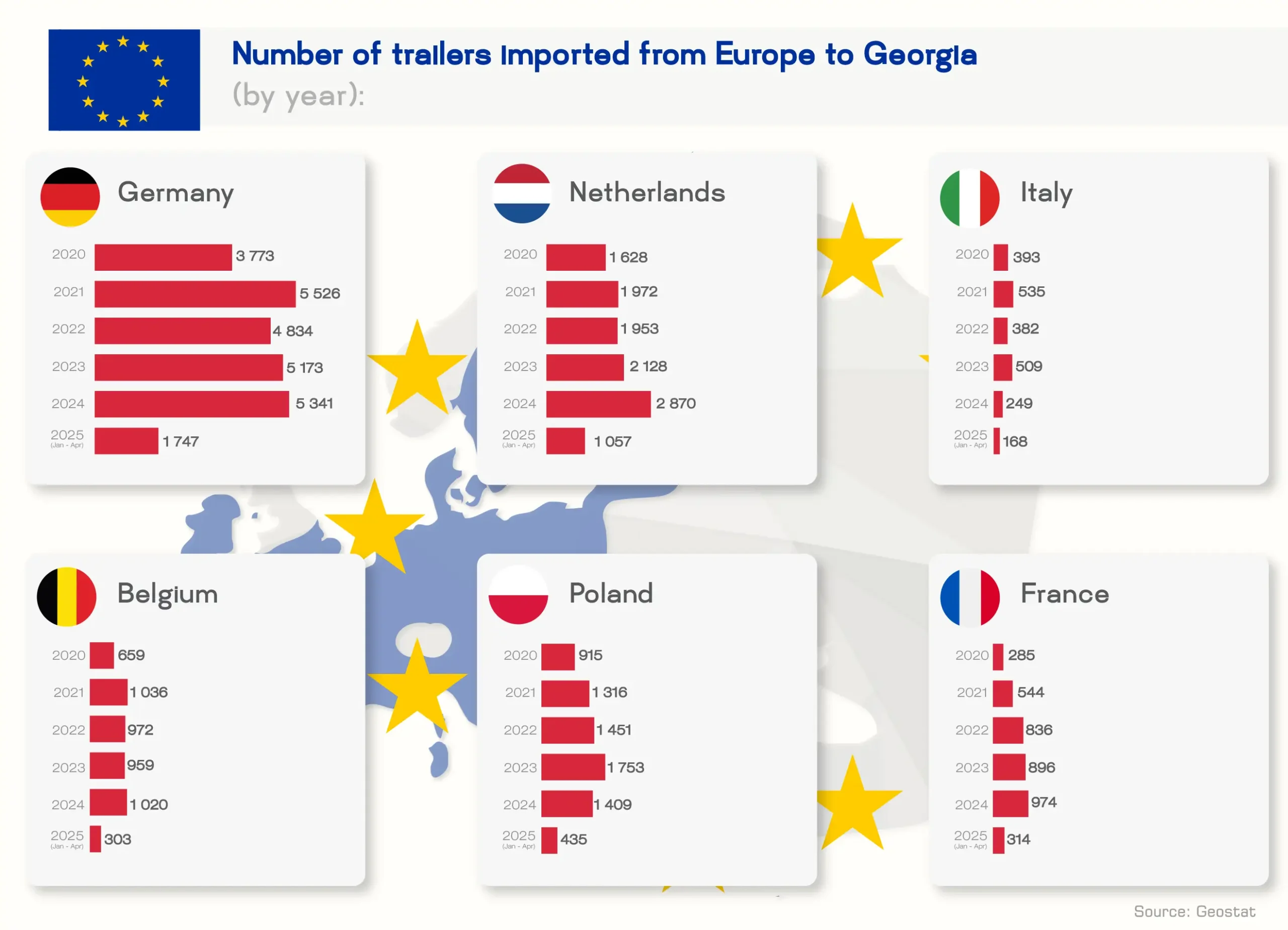

The study of truck delivery schemes in Russia we began with the analysis of Georgia’s import-export statistics. These figures reflect the official data produced by Georgian customs authorities. We observed that imports had already been increasing annually even before the war, but the numbers became more pronounced after 2022. The majority of trucks imported into Georgia come from Europe.

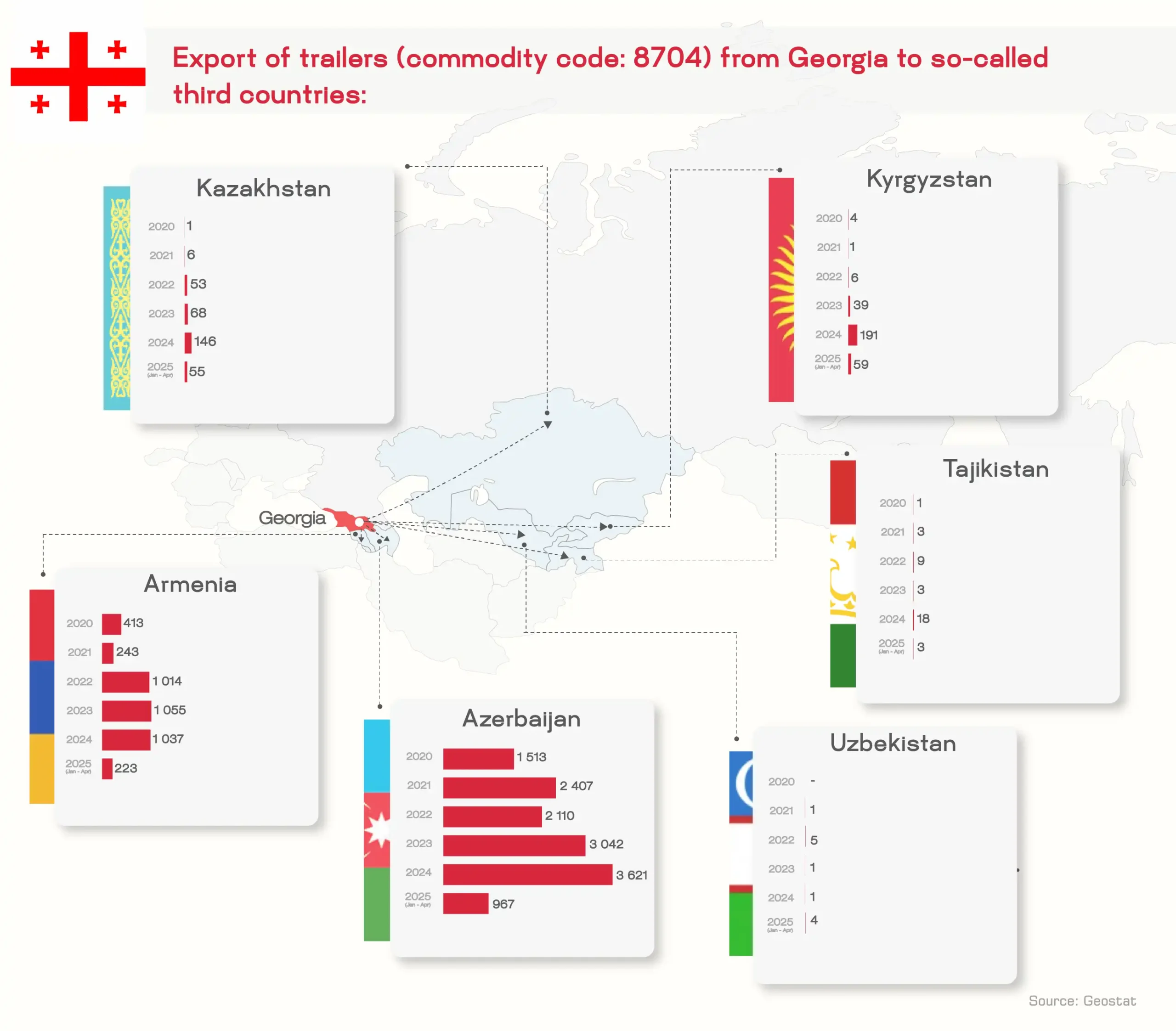

Alongside the increase in imports, exports also rose — but not directly to Russia. Instead, they were sent to third countries: Azerbaijan, Armenia, Uzbekistan, Kyrgyzstan, Kazakhstan, and Tajikistan. For example, from 2022 through April 2025, 322 trailers were exported to Kazakhstan, while in 2019–2021, only 14 were sent.

The case of Kyrgyzstan is particularly noteworthy. Georgia had traded trucks with Kyrgyzstan in the past, but on a much smaller scale. Before the war, over the nine years from 2013 to 2021, only 31 trailers were sent from Georgia to Kyrgyzstan. Yet from 2022 to the present — in just three years — that number increased ninefold to 295. The total export value also rose by a factor of 19.

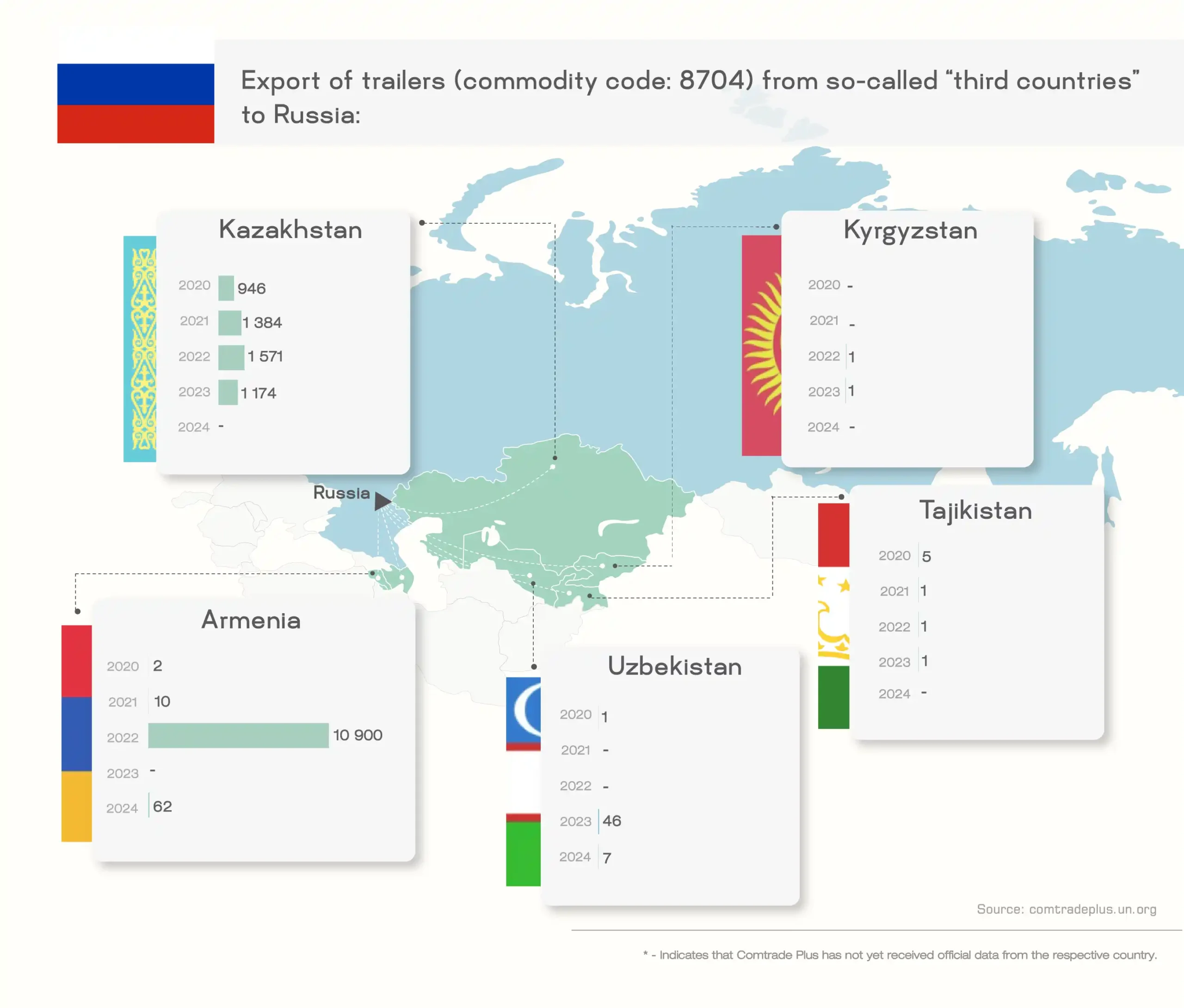

Neighboring Armenia has also become a significant trader of trucks with Russia. While only 10 trucks were exported from Armenia to Russia in 2021, that number skyrocketed to 9,256 in 2022 — a 92,460% increase.

The fact that these so-called “third countries” ramped up their trailer trade with Russia is confirmed by official UN data as well.

It will be clear to anyone who frequently travels on transit highways that statistics are not wrong and the data reflect reality. On May 3, we were at the Armenian border, at the Sadakhlo customs checkpoint, where we encountered a queue of trucks heading towards Armenia. We spoke with the drivers standing there. Two of them, Kachik and Razmik, were jointly explaining to us what schemes Russia uses to fill the deficit cargo.

“Russia is under sanctions everywhere, and it moves like this, in roundabout ways, circles around. From here to there, from there to here, and finally, it goes back to Russia. From Georgia to Armenia, from Armenia back again – in the end to Russia,” says Razmik.

“Look, our trailers are European, and their parts are also European. Russia is under sanctions, so how do these parts go to it? How do they go – with the help of Armenia, Kyrgyzstan, Kazakhstan,” added Kachik.

“They carry a lot. Mostly Kazakhs and Uzbeks carry. Now it is few, but on New Year’s, 40-50 units were crossing per day. They are transporters, they buy and take it,” – told us Ali, who lives near the Azerbaijani border, at the Lagodekhi checkpoint, in February. He also added that, by his observation, trailers often have transit numbers attached.

What Ali said was confirmed by taxi drivers who work directly at the Lagodekhi border checkpoint and monitor vehicle movement daily.

“At this moment, there is nothing; when there is snow, it is stopped. Before it was… all go from here… those with trailers go in transit, and those without trailers too,” – told us a driver who refrained from revealing his identity publicly.

Nor did they hide it at the Lars border; trucks from Georgia, or those passing through Georgia, are taken to Russia with the help of various countries and schemes.

In analyzing foreign trade data, we also found that part of the trailers sent from Georgia to Kyrgyzstan never reached their destination in Kyrgyzstan. In 2023-2024, 230 trailers were exported from Georgia to Kyrgyzstan, but only 43 reached Kyrgyzstan. This statistical discrepancy may also be caused by the fact that the recipient country, that is, Kyrgyzstan, registered this cargo not as Georgian, but as an export from the country from which the truck originally departed, for example, Germany. However, what is noteworthy is that, before the war (before 2022), the data from Georgia and Kyrgyzstan matched when traded using this code.

Heavy equipment sent from Georgia also fails to reach Kyrgyzstan. We detailed this in an investigation published two weeks ago.

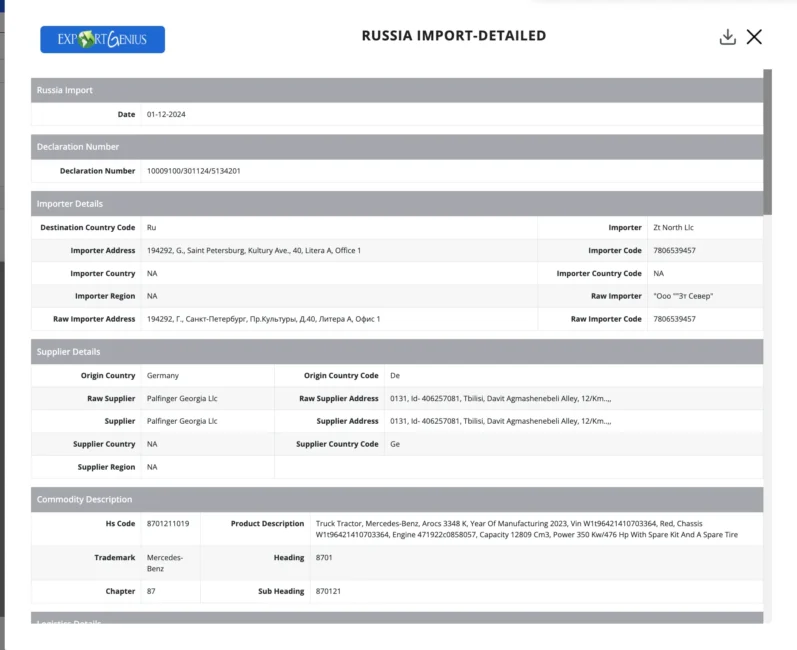

In 2024, the Georgian company “Palfinger Georgia” sold four red Mercedes-Benz trucks to Kyrgyzstan, produced in 2023. In total, it is worth 560,000 dollars. However, none of them reached Kyrgyzstan and remained along the way in Russia, with Russian companies Logispot and ZT Sever.

“Palfinger Georgia” was registered in Georgia in 2018. Its owners are Australian citizen Nikolai Ageev (born in Russia) and Russian citizen Alexei Gorski. These same individuals also own the Russian company ZT Sever, to which “Palfinger Georgia” supplied two sanctioned trailers in 2024.

ZT Sever and Logispot are registered at the same address. At this address, Ageev and Gorski have registered six additional companies. The official owners of Logispot are Kristina Aleksandrova and Elena Diskalenko.

Since 2022, “Palfinger Georgia” has been an exporter to Russia of various products, including heavy machinery parts, steel and plastic products, hydraulic cylinders, and regulators. From August 2022 to December 2024, “Palfinger Georgia” delivered 1.2 million dollars worth of Austrian, Swedish, German, and Bulgarian products to Russia. The recipient of all these products was the Russian company Logispot. ZT Sever appeared as a recipient in December 2024.

Since 2019, “Palfinger Georgia” has been the representative in Georgia of the Austrian crane manipulator company “Palfinger.” The Austrian “Palfinger” also has a representative office in Russia, in Saint Petersburg. According to the professional company and market analysis system Spark, the Austrian company “Palfinger” had 2.3 billion US dollars in revenue and employs more than 12,000 people.

The Georgian office mainly trades in trucks and heavy equipment. According to Reportal’s 2023 report, the company is loss-making. From Georgian state agencies, it has received four contracts worth 105,000 GEL for the supply and repair of equipment parts.

We contacted the executive director of “Palfinger Georgia” for a comment. She told us that she has not sold anything to Russia and that this is technically impossible because shipments of European products to Russia are sanctioned.

“In the declaration, I write the country and sell to the country from which I have the order. Let’s say I have an order from Turkey. They transfer the money to me, and I sell, and I export to Turkey. I don’t handle transportation. I sell to Turkey; it’s taken to Turkey. How can it go elsewhere? … What do I have to do with this? I don’t understand. Someone sold something somewhere, resold it, and then resold it again. What can I do? … In the future, if I get orders from these companies, I will refuse and no longer accept their orders,” Natia Khorbaladze told us in a phone conversation.

After this conversation, we continued the investigation and discovered the Russian companies owned by the Russian owners of “Palfinger Georgia.” Later, we sent a text message to Natia Khorbaladze stating that we knew the details of their involvement in the scheme and offered her a chance to respond if she wanted to add anything. However, we did not receive a reply from her.

By participating in such a scheme, Georgia does not formally violate sanctions, as the sanctioned cargo is sent to other countries, not to Russia. According to Georgian legislation, re-export to third countries (excluding Russia) is permitted, allowing the Revenue Service and customs to justify their actions by stating that they cannot control the destination of sanctioned cargo after it enters the territory of other countries. If developed countries of the world genuinely want to achieve the intended effect of sanctions, then they must consider this scheme more thoroughly and its potential shortcomings. Ultimately, we will provide an example of what can be achieved.

Which Georgian companies benefit from the operation of these schemes?

While working on this article, we identified approximately 50 Georgian and foreign companies and individual entrepreneurs in international databases that export trucks from Georgia to Russia using various schemes.

Among these 50, the case of LLC “Enterprise” stands out for its scale. In 2023, the company delivered 33 German-manufactured MAN trucks to Russia, with a total value exceeding $4 million.

By studying the ImportGenius, ExportGenius, and SAYARI databases, we found that “Enterprise” received orders for these trucks from Turkish companies LYSCHOR GUNEY ELEKTRIK TICARET LIMITED SIRKETI (8 units) and EXIM TURKEY EV TEKSTIL URUNLER TICARET LIMITED SIRKETI (25 units). The receiving Russian company was ООО ЛАКОР.

The trucks were transported from Germany to Georgia, then to Azerbaijan. From Azerbaijan, they entered Dagestan (Russia), and from Dagestan, they finally ended up in Saint Petersburg. In this scheme, from the starting point to delivery, the supplier was LLC Enterprise.

- LYSCHOR GUNEY ELEKTRIK TICARET LIMITED SIRKETI was founded in Trabzon in June 2022. Its founder was Israeli citizen Alexey Smolyanov. In May 2024, the owner became Ramadan Fayzil Kurt, who bought the company for 500,000 Turkish lira, about $15,500. The company’s activities include the import and export of all types of electronic and mechanical materials.

- EXIM TURKEY EV TEKSTIL URUNLER TICARET LIMITED SIRKETI was registered in Istanbul on January 20, 2023. Its owner is a Russian citizen, Sergey Melnichenko. Although the company’s stated activity is import-export of household textile products, in reality, it is a multi-profile company actively involved in international trade, specifically with Russia.

- ООО ЛАКОР is a Russian brokerage and logistics company registered in Saint Petersburg in 2010. Its owners are Russian citizens Dmitry Mayorov, Yuri Kovalev, and Vladimir Lemishko.

The trucks delivered to Russia by “Enterprise” are also mentioned in a study by Norwegian analytical company Corisk, which examined the export of foreign and sanctioned cargo from Georgia to Russia between 2022 and 2024.

LLC “Enterprise” was registered in Georgia on April 10, 2019. Its shares are divided as follows: Lia Tsakadze owns 90%, while Petre Tsakadze and Shota Mshvildadze each own 5%. Lia Tsakadze is the wife of “Tegeta Holding” owner Temur Kokhodze. Petre is Lia’s nephew and Chief Officer of light vehicle division at “Tegeta Holding.” According to his Facebook profile, he is also the director of Porsche and Mazda centers. Shota Mshvildadze has served as Tegeta’s corporate sales manager since 2021 (his current status is unknown).

All shareholders of the company are closely connected with “Tegeta Holding.” Since 2006, “Tegeta” has been the official dealer of German MAN in Georgia. The business field of “Enterprise” is the import-export of new and used cars.

We called the company director, Tamar Gelishvili, and asked why “Enterprise” helps Russia receive sanctioned cargo.

“Why should I answer you about anything, if it participates, I don’t know… It doesn’t participate, but why should I answer you […] we don’t deliver anywhere. We sell, and then the reseller takes it; we don’t know anymore. So what, what route it took, I don’t know,” Gelishvili told us. She added that she is doing more important work than investigating this matter and doesn’t have time.

We called “Tegeta Motors” PR several times, but received no answer. Then we called the hotline and explained that we were preparing an investigative piece and needed to interview their representative. They clarified the information several times, took down the journalist’s number, and promised the relevant department would contact us. They also asked us to email them the topic and our interview request. We did everything as requested, but received no response. Before publishing the article, we wanted to follow up one more time, but the hotline informed us that our number has been forwarded, and the press office would contact us if necessary. We waited in vain for the call.

We also contacted the German MAN. We asked what they knew about their trailers being exported to Russia. Despite waiting ten days, we received no response. Since MAN didn’t reply by email, we reached out via social media. On May 28, they wrote that due to a holiday in Germany, delays and timely responses are hindered. If we receive a reply, we will update the text.

While we’re at it, let us also tell you what other truck manufacturers responded. We contacted all the companies whose vehicles are under sanctions but still end up in Russia through various schemes.

VOLVO responded on May 23: “After the full scale invasion by Russia we have remained committed to complying with all sanctions against Russia. Volvo has implemented a range of contractual and due diligence measures to ensure compliance with sanctions in its dealings with agents, dealers and customers, including in contracts and screening processes. If we find evidence of a customer violating these terms then we take appropriate action, such as ceasing business with them.”

Following this message, we provided VOLVO with the VIN codes (unique vehicle numbers) of three trucks we found that entered Russia through Georgia. They replied that these trucks are recorded in their system as sold to partners operating in Europe and Central Asia. “our records show that these trucks were sold by Volvo Trucks in 2023 to local partners outside Russia and Belarus, in regions Europe and Central Asia. While we do not comment on individual sales, we can confirm that we had no indication that these trucks would end up in Russia or Belarus.”

MERCEDES, which is part of Daimler Truck, answered our questions on May 26. They told us that from the very beginning of the war, they completely ceased operations in Russia and suspended all activities linked to Russia. They withdrew all their staff from the country. “Daimler Truck has taken comprehensive measures on the part of the Daimler Truck Group to prevent illegal exports of vehicles or vehicle parts to Russia. In addition, Daimler Truck is constantly checking the extent to which further measures are required. In addition, Daimler Truck has repeatedly notified its business partners that deliveries of Daimler Truck products to Russia are not accepted, and Daimler Truck takes appropriate measures in the event of potential violations.”

Swedish SCANIA has not yet responded to our inquiries.

Fruit on the Manifest, Parts in the Trailer

LLC “Union Export 2024” was established in Sighnaghi, Georgia on May 27, 2024. Within two weeks, it began exporting fruits and vegetables to Russia. You might be wondering — why did this company end up in this investigation? The thing is, in 2024, this company delivered truck parts worth $246,425 to Russia. This cargo has been sanctioned since 2023.

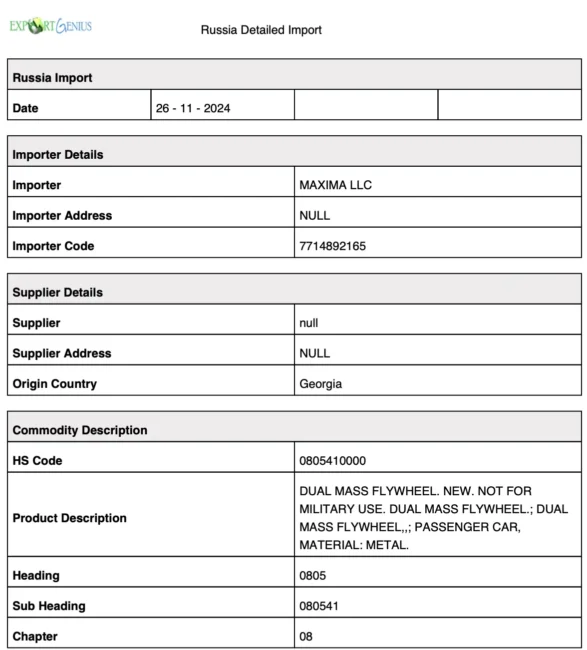

If we ask the Georgian customs service, the company based in Sighnaghi exports apples, grapes, citrus fruits, and potatoes from Georgia to Russia. However, in declarations provided by Russia’s customs service to international databases, it is written that in November 2024, LLC “Union Export 2024” brought vehicle parts into Russia along with fruits.

“Union Export 2024” frequently delivers fruits and vegetables to Russia. Between June and December 2024, it delivered or sent cargo to Russia at least 2,000 times. In most cases, the cargo and its assigned code matched, but there were at least 23 instances where vehicle and heavy equipment parts were hidden under the code for fruits and vegetables.

According to a customs declaration uploaded to the ExportGenius database, the recipients of the auto parts imported into Russia by “Union Export 2024” were the Russian companies MAXIMA LLC, LAZUR LLC, and AGRINOVA LLC. Among these three, MAXIMA LLC most frequently received vehicle and heavy machinery parts registered as “fruits and vegetables” — totaling $196,123. The official activity of this Russian company is wholesale and retail trade in auto parts.

The owner and director of “Union Export 2024” is 55-year-old Besik Sikmashvili, who owns two other companies as well. The main activity of all his businesses is trade in food products and fruits and vegetables.

We contacted Besik Sikmashvili and asked how it happened that a fruit and vegetable exporting company was sending sanctioned auto parts to Russia. Sikmashvili initially told us he would look into it, that he had four authorized agents involved in exports, and requested detailed information about the cargo. Later, he told us that he couldn’t figure anything out, because the weight information we provided did not match the figures in his accounting records and the numbers indicated in Georgian customs declarations.

We asked Sikmashvili to send us the Georgian customs declarations, but we did not receive this information from him. In the phone interview, Sikmashvili categorically denied the fact of sending auto parts to Russia, although he did mention the following phrase: “Maybe the driver ‘fixed something’ in the neutral zone.”

“My company’s name won’t be harmed, everything went properly from here, and what happened there in Russia, how can I be responsible for that?” – Sikmashvili returned the question to us. We asked him to name the authorized agents who conduct exports through his company, but he refused to do so.

During the communication with Sikmashvili, we debated whether to leave this story in the article or delete it. But since we did not receive any evidence from Sikmashvili contradicting the information presented in international databases, that’s why you are now reading this story.

What Can Be Done?

We asked the Revenue Service how many new transit-numbered trucks crossed the Lars border after the war began. We are still waiting for a response. In principle, Georgia’s customs service should be able to observe how the number of transit-numbered trucks heading from Georgia to Russia has increased. For people traveling on the roads, this is usually visible.

We also asked the Revenue Service whether they are aware of the specific cases described in this article and what they plan to do about the loopholes that are actively exploited by private individuals and companies. We provided the unique numbers of specific vehicles, but we have not received responses to these questions either.

As an alternative, we offer several steps that the Revenue Service can take against these schemes. The information is based on Lithuania’s experience:

- Investigate and identify the companies or individuals participating in dishonest schemes;

- Introduce strict regulations requiring exporters to have information about the final owners of the cargo and to present these details to customs;

- Restrict export rights of legal entities involved in supplying sanctioned equipment to Russia through third countries until investigations are complete;

- Require additional documentation for exporting sanctioned equipment to Central Asian countries, obligating the buyer not to resell the equipment in violation of international sanctions;

- Periodically review international trade databases to understand where supposedly Kyrgyzstan-bound sanctioned cargo actually ends up.

Some of the raw data from international databases was obtained by OCCRP ID and Erlend Bjørtvedt, the founder of the Norwegian analytical company Corisk.

This article was produced by:

Journalists: Ia Asatiani, Aidan Yusifi, Mariam Kachkachashvili

Graphic Designer: Nino Gagua

Editor: Nino Bakradze